For foreign trade SOHO businesses, selecting a reliable and efficient payment method is essential for smooth transactions and business operations. In this article, I will introduce XTransfer, a highly recommended payment platform for foreign trade professionals.

XTransfer: A Leading Solution for Foreign Trade SOHO Payments

I have tried various payment methods for my foreign trade business over the years. Initially, I used a Hong Kong HSBC account for five years, but due to audit issues, the account was closed in 2018. Afterward, I registered a new company, opened an account with Bank of China in Hong Kong, but that account was also closed within two years due to various issues. With mounting operational costs, I stopped focusing on Hong Kong-based accounts.

In the search for better options, I used accounts from friends and registered a Commercial Bank of Yiwu account. However, none of these solutions proved convenient. It wasn’t until a friend recommended XTransfer that I found a reliable platform for my needs.

Now, XTransfer has been smooth sailing—it’s easy to create invoices, enter customer details, request payments, and even convert payments into RMB directly. I highly recommend it to anyone asking for a payment solution.

Why Choose XTransfer?

XTransfer, backed by China Merchants Group, offers free account setup and management for foreign trade companies and supports legal foreign exchange settlements. Currently, XTransfer serves over 300,000 customers, positioning itself as a leader in the industry. It does not charge account opening fees, management fees, or annual review fees. If the account is unused, no fees are incurred. The platform charges a small handling fee of 0.4% for currency conversion.

How to Use XTransfer: The Registration Process

- Enterprise Certification

Verify if your business can be approved for XTransfer. This involves submitting necessary documents about your company. - Account Setup

Once certified, you will be issued a USD account. You can then provide this account to your clients to receive payments via TT wire transfers. - Receiving Payments

Once you receive payment, you can either transfer the USD to a domestic RMB account or directly convert it into RMB. - Required Documentation

- For unshipped orders, you need to provide communication screenshots, such as emails or messages with the client.

- For shipped orders, you can provide shipping documents such as the Bill of Lading or tracking number.

XTransfer Benefits & Drawbacks

Benefits:

- RMB Conversion: You can receive payments in RMB without being limited by the personal $50,000 foreign exchange quota.

- Unlimited Domestic Transfers: There’s no limit to the amount you can transfer from USD to RMB.

- Unlimited International Transfers: Sending payments abroad, such as commissions or trade payments, is also not restricted.

- No Maintenance Fees: There are no account maintenance fees or requirements for financial products.

Drawbacks:

- New Clients: You must provide order communication details, order information, and website details when setting up your account. This is part of their stringent risk management to prevent money laundering.

Eligibility: XTransfer is open to mainland Chinese companies, individual businesses, and Hong Kong-based companies.

Alternative Payment Methods for Foreign Trade SOHO

While XTransfer is highly recommended, there are other commonly used payment platforms for foreign trade businesses. Here’s a brief overview of some alternatives:

1. Western Union (WU)

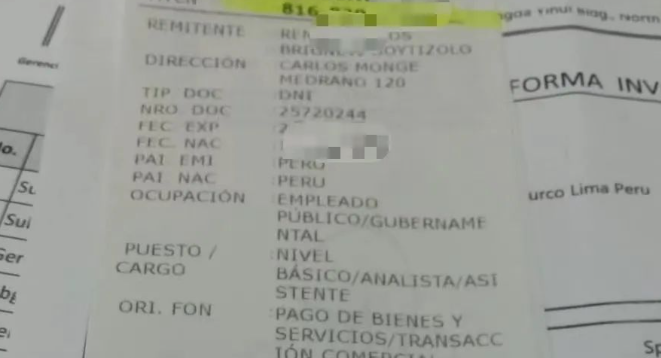

- How it works: Western Union requires no account setup. You only need to provide your name (in Pinyin) and address for clients to send money. Once the payment is made, you receive an MTCN code, which can be used to collect the funds at a partner bank.

- Ideal for: Small transactions, payments between friends or family, or low-risk commercial transactions (up to $5,000).

- Limitations: Western Union doesn’t officially support commercial transactions, and the frequency or amounts should be kept low to avoid flagged accounts.

2. PayPal

- How it works: PayPal, founded by Elon Musk, is similar to Alipay in China. Payments are transferred instantly into your account once clients pay using email-linked accounts. PayPal has a Buyer Protection Program, meaning clients can file disputes and request refunds, which might be a risk for sellers.

- Ideal for: Sample orders, high-quality customers, and those who want instant payments.

- Limitations: High transaction fees (around 5%) and potential issues with account freezes or disputes.

3. AliPay Cross-Border Transfers

- How it works: AliPay allows international transfers to China, typically converting payments to RMB. The platform is generally more convenient for domestic users but has limited flexibility for international transactions.

- Ideal for: Businesses that already use AliPay for domestic transactions and need to collect payments from international clients.

- Limitations: Payments may require additional verification and might not be as seamless for larger, international transactions.

4. Offshore Bank Accounts (TT Payments)

- How it works: These accounts are usually set up with banks outside of China (such as in Hong Kong). They allow for higher security and are commonly used for large trade transactions. However, they often come with high setup and maintenance costs.

- Ideal for: Larger businesses, SOHOs, and companies handling high-volume or international trade.

- Limitations: High setup costs and ongoing maintenance fees. They are not as quick or flexible as digital payment platforms.

5. Domestic Import/Export Accounts

- How it works: A registered Chinese company with import/export rights can open an official foreign currency account for receiving payments from overseas clients. This involves formalities like invoices, customs declarations, and VAT procedures.

- Ideal for: Larger businesses that engage in bulk international trade and are eligible for export tax refunds.

- Limitations: Requires more administrative effort and is suitable for companies that have the proper import/export qualifications.

Conclusion

For foreign trade SOHOs, choosing the right payment solution is crucial for business efficiency and customer satisfaction. XTransfer stands out as a reliable, cost-effective, and hassle-free solution for handling international payments, particularly for those who want flexibility and low fees.

However, depending on the nature of your business, you might also consider using PayPal, Western Union, or even traditional offshore accounts for larger transactions. Each method has its benefits and limitations, and it’s essential to assess your business needs before selecting the best option.

Remember, selecting the right payment method can streamline your business operations, reduce costs, and enhance the customer experience.